Mazars panel explores link between culture, strategy and performance

Seeded from our debate on the ethical and behavioural aspects of culture at the regional conference in March 2016, panellists from the investor and corporate communities shared their perspectives on the link between culture and strategy and the impact on performance and included:

- Gwen Le Berre, Director – Proxy & Governance, Charles Schwab Investment Management

- Evan Harvey, Director of Corporate Responsibility, NASDAQ

- Andrew Johnston, Group Company Secretary, Altron

Chaired by David Herbinet before an audience of over 100 investors and governance professionals, the panellists explored the responsibility of executive management and the board in creating and driving corporate culture, highlighting the dangers of cultural disconnect and exploring various means of understanding the existing culture from grass roots level.

While all were in agreement that openness and transparency are essential in building trust, the panel became animated when discussing formal and informal communication with investors and debated the merits of regulation, corporate governance codes and voluntary initiatives.

The conversation touched briefly on the reciprocal influence between the brand and culture and the positive impact this has on long-term success, particularly when it comes to attracting top talent amongst millennials, before opening questions to the audience.

Culture and its influence on long-term success emerged as a dominant theme throughout the conference, reinforcing the relevance of the topic and its position as a global issue.

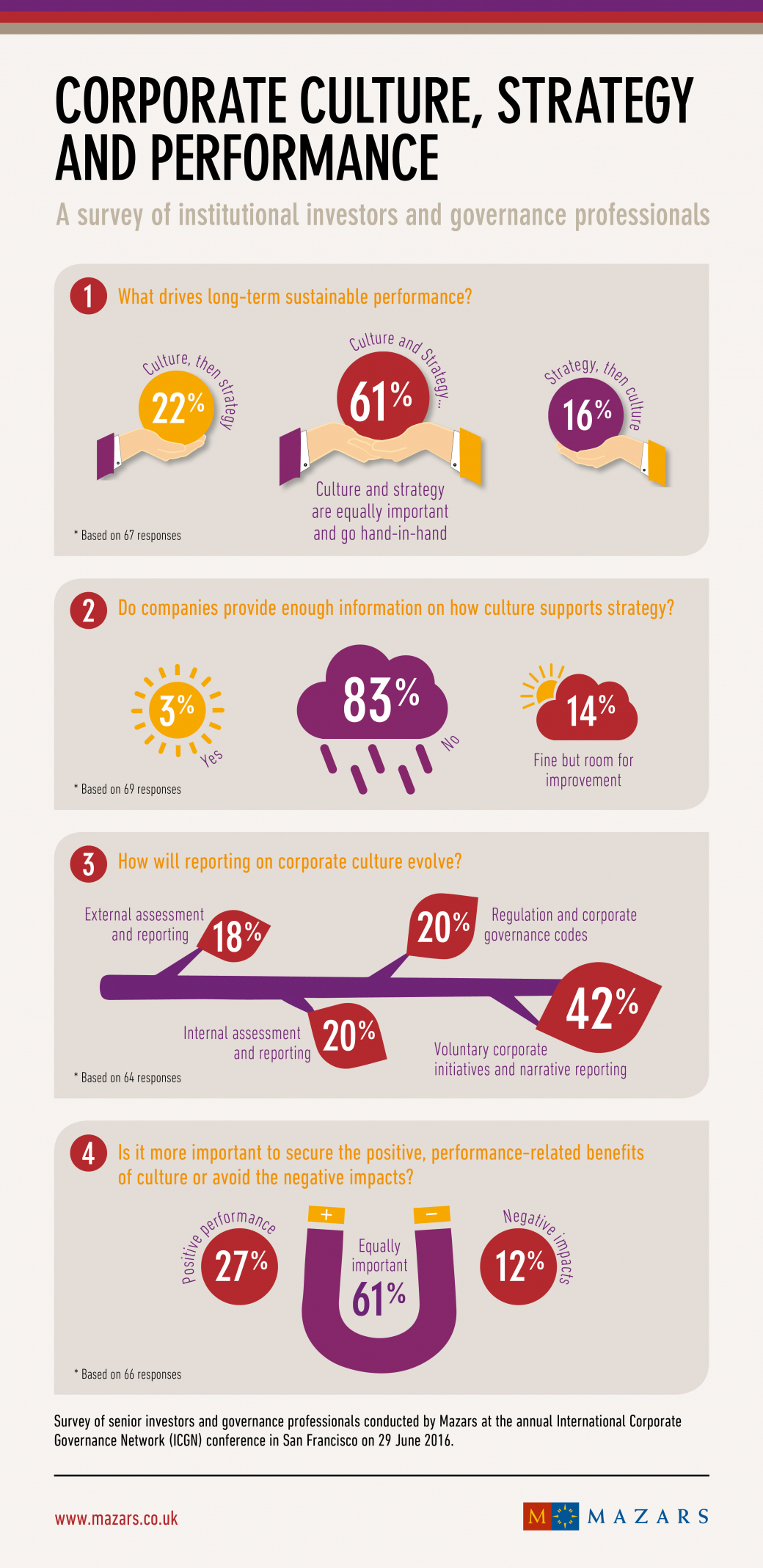

Audience participation in a Mazars-led survey set the scene for the discussion which revealed the majority believe that culture and strategy are equally important when it comes to driving sustainable performance. While an overwhelming 83% don’t believe companies are providing enough information to investors on how their corporate culture supports the delivery of their strategic objectives, the majority expect this to evolve over time (70%). There was less agreement over the best way for reporting on culture to evolve - 42% view ‘voluntary initiatives and narrative reporting’ as most effective, followed by ‘reporting in line with regulation and corporate governance codes’ (20%) and ‘internal assessment of culture and reporting’ (20%).

We are proud to be associated with ICGN. This panel discussion built upon the themes that emerged from our conversation with investors at the regional conference in March 2016, allowing us to strengthen our profile and further build relationships amongst the ICGN community and it demonstrates the benefits of our continued support of ICGN at Group level.