IND AS Impact | Automotive Sector

This sector is extremely important to the country, creating 19 million additional jobs in 2006-16. It amounted to 7.1% of the total GDP, contributing to 4.3% to exports and 13% to excise incomes in 2014-15. T

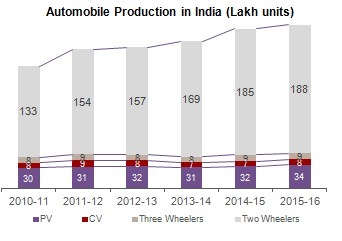

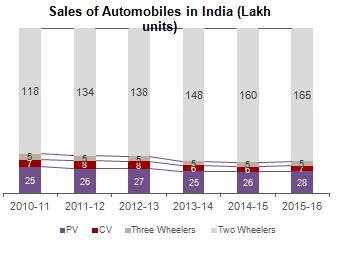

The Automotive Mission Plan (AMP) 2016-26 aims to promote Indian automotive manufacturing and to develop it as one of the top three manufacturing hubs in the world. The plan has been aligned with the make in India campaign. It aims to spend about $80 billion in capital investments and introduce world class emission norms. To this effect, the government has created crash test centers and centers of excellence at a cost of about $280 million. Apart from this, the government is also promoting The National Electric Mobility Mission (NEMM) Plan 2020 that aims to promote hybrid and electric vehicles.he country produced about 23.9 million vehicles in 2016. Within the sector, two wheeler segment, dominates production and sales of automobiles at about 80%, while Passenger Vehicle segment comes in second with about 14% market share.

While many plans have been proposed, their effective implementation remains a key challenge. Other challenges miring this sector are lack of innovation, lack of value added high-end products, and lack of focus in after-market export potential. With good monsoon and the 7th pay commission, overall industry is expected to grow by 15.6% in 2016. India’s passenger car market is expected to reach sales of four million units by 2020, up from 1.97 million units in 2014-15. According to the AMP, the Indian automobile sector has the potential to generate revenues up to $300 billion and contribute about 12% to India’s GDP.

Impact Of Ind-as Adoption On Automotive Sector

Revenue Recognition

Besides other factors, due to complex sales promotion strategies, revenue recognition becomes a multifarious area for consideration while applying the new revenue recognition requirements under Ind AS.

Embedded Lease

Due to outsourcing of manufacturing of certain components to outsiders by vehicle manufacturers and component suppliers, the assessment of embedded lease (new concept) becomes important.

Consolidation

Ind AS differs in various aspects and has wider concept of the term ‘control’ as compared to the existing practices, thereby would have significant impact on consolidation of entities.

Impairment of Assets

There being significant differences between the two sets of accounting principles, the impairment assessment would undergo some changes.

Moulds and Tooling

Determination of these as inventory or PPE and their capitalization by original equipment manufacturer or by the component manufacturer are important consideration on Ind AS adoption.

Other Areas

- Research and Development Cost

- Property, Plant and Equipment

- Discounting of certain items

- Use of fair value accounting

- Restatement of financial statements due to certain items and circumstances

- Recognition of proposed dividend

- Additional disclosure on related parties

- Segment reporting disclosures

- Additional disclosures on income taxes

- Debt equity classification Government grants